Houses grew to become a whole lot more reasonable than in the sooner point in time, due to the competitive credit cost within country. Together with, elite group lenders or other creditors possess reinforced the convenience out of the whole process of providing houses finance. Thus, it builds demand amongst reasonable, mediocre, and you can superior sector consumers.

Getting the own home is actually unarguably an extraordinary profits and you may good manifestation of stability and personal progress. And you may, while you are providing an excellent 40,000 income in 30 days, practical question you need to be experiencing are, Just how much mortgage do i need to log on to an excellent 40,000 paycheck? There are certain issues you to determine the loan number, also to know it way more closely, we are going to talk about the extremely important considerations and skillfully advised procedures so you’re able to get an amount borrowed effectively.

What is the maximum amount borrowed having a good 40000 income?

The level of the loan one could discover which have a monthly income out-of ?40,000 is purely determined by individuals things. A person has to-do all the qualification requirements, including the fresh CIBIL rating, current work reputation, effective mortgage in the borrower’s name, and you will financing period. Typically https://paydayloancolorado.net/portland/, loan providers often choose a debt-to-income proportion code to determine the loan amount to possess a particular candidate. Together with, salary issue is important because the lender identifies the brand new EMIs depending on your own monthly earnings.

Although not, which have an income of forty,000, it’s possible to assume a loan amount varying ranging from ?20 and ?twenty five lakhs having a period of around 2 decades on a great realistic rate of interest. Seem to, these figures are different based upon the latest lender’s procedures you need to include factors to look at when you’re approving the loan software. It is best to see the qualification criteria a lender has to follow, and you will smart planning is vital to possess a mellow mortgage procedure.

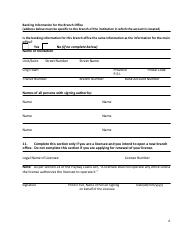

That have a paycheck from Rs forty,000, we offer another financing numbers off more banking institutions:

Note: Another table brings a standard imagine and genuine eligibility could possibly get will vary according to private things. It’s necessary to consult with a lender for particular advice.

How do i have a look at my personal home loan eligibility?

The process of checking mortgage eligibility involves multiple activities. This is the right direct you normally opt to follow getting a flaccid loan application:

- On line Loan Calculators: Whenever you are seeking a trusted lender and going to the other sites, you must have observed an effective calculator readily available here. Really financial institutions and you may banking companies promote on line mortgage eligibility to allow easier for consumers to check on what you on their own. Therefore, one could need after that tips appropriately.

- Evaluate your credit rating: Try keeping examining your credit score frequently. With a beneficial CIBIL constantly benefits you in several ways. In addition to, it advances your chances of bringing a softer financing processes also regarding the lack of one required data files.

- Get a monetary Advisor: That have a financial advisor with you will allow you to safer an effective amount borrowed. Plus, he’s going to show you to make greatest future economic plans to be eligible for the desired mortgage.

Document Needed for home financing

Paperwork are an option planning, especially when making an application for home financing. Data files to make certain a loan provider that applicant can perform and also make the brand new monthly EMIs and can repay the amount as per the felt like period. We have narrowed down the menu of commonly needed records less than:

Title and you can Domestic Facts: Speaking of a couple very important files one cannot miss locate a great financial. You can look at appearing your passport, riding permit, ID cards, Aadhar credit, an such like.

Earnings Research: In spite of the salary you’ll receive paid for your requirements, it is usually necessary to upload the funds facts. This can be must determine what you can do to repay the borrowed funds. And additionally, when you are a good salaried applicant, the lender or bank have a tendency to ask you to upload your own salary slides.

Possessions Files: With regards to lenders, assets files, as well as deals preparations, assets income tax receipts, etcetera., will be questioned become uploaded into the on the web application for the loan.