Will you be thinking you could potentially buy a great fixer top? Whenever you are very looking property that might need some work, you have to know there exists higher options for this. Your ideal domestic could be the one that just needs a small TLC. Before you make people ine both household along with your needs and you can capabilities. Listed here are ten things to consider before you pick a great fixer higher:

Consideration step one: Remodeling a house yourself are going to be a good idea, you is going to be willing to place in most, if not completely, time to that repair. Before you make that ultimate decision and there is zero heading straight back, inquire whether you are capable take on the work. Their vacations is spent sanding and you will decorate for just what could end up being a long time.

Believe dos: Figure out what is actually really completely wrong towards the family. Make a list of everything you our house need repaired otherwise updated. It’s anything should your household needs cosmetic makeup products repairs such as for example replacement shelves otherwise refinishing wood floors, as these anything should not break the bank. Certain cosmetic makeup products changes can usually performed your self in the event the youre convenient.

Attention step 3: Architectural items including the roof, foundation, otherwise drainage solutions could cost a king’s ransom to resolve, so be sure to browse the residence’s construction and significant options. In case the residence is wanting a great deal from the technique for structural repairs, you’ll be able to think again the choice to acquire a great fixer higher.

Said cuatro: In which do you really alive although you upgrade? For those who have in other places you could potentially alive although you carry out home improvements, the theory to buy an effective fixer upper could be an effective suggestion to you. On top of that, if you would like quickly are now living in the house their to get, this can be an issue. If the family isn’t really livable instantly, know that remaining in a lodge for a long period whenever you are you will be making repairs and you may enhancements can not only become a hassle, it can be quite expensive.

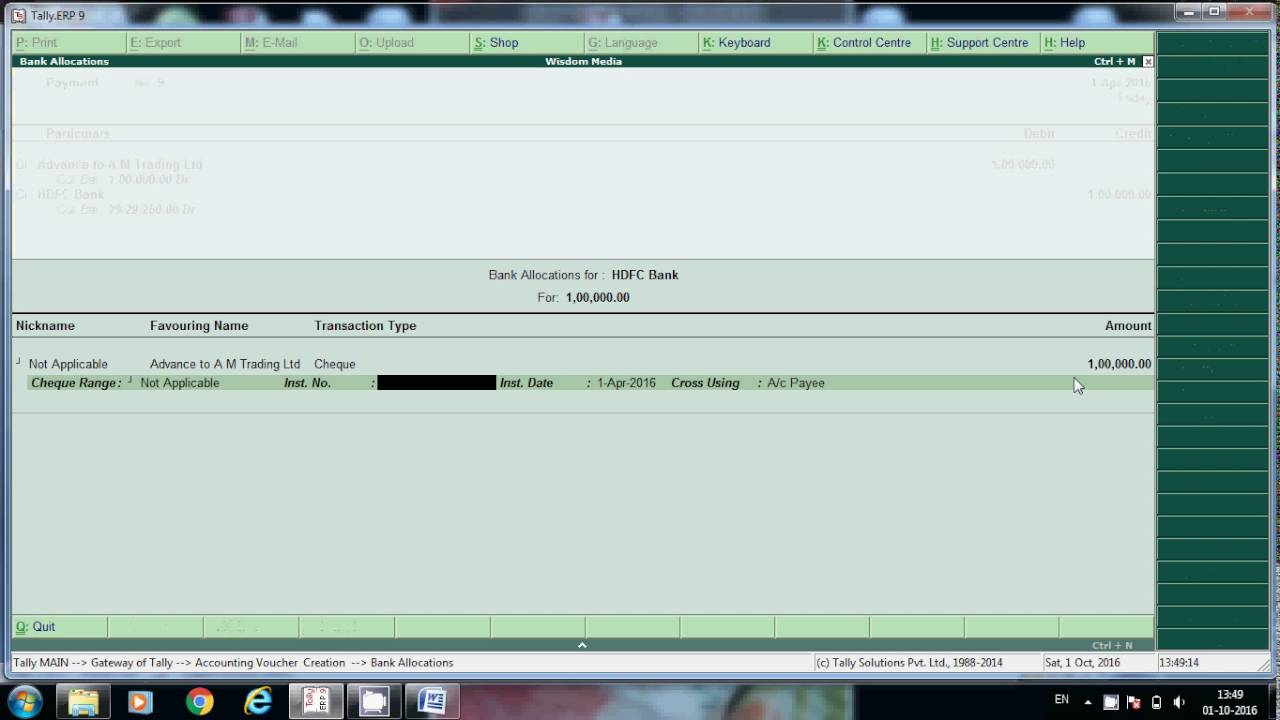

There are 2 style of 203(k) loans, a simple loan and you may a smooth mortgage

Planning 5: You should know when you should get a specialist and make sure you earn the correct one. You will want to take some time and you will carry out thorough search in advance of choosing builders for your home repair means. When interviewing, make you decision out of a list of at the very least three builders. It is critical to question them for many recommendations and you may advice of their earlier in the day really works. Never capture a builder in the its phrase in place of enjoying facts, and always rating estimates and you will agreements in writing in advance of it initiate work at the house or property.

Planning six: Be truthful having your self. Are remodeling property really within your budget? When you’re struggling to find the income to have an all the way down commission, the decision to buy a fixer upper might not be the brand new most effective for you. Even when you have you money booked, you are going to usually you need more having shock things. Although not, you can find capital solutions that might lessen the quick rates burden of renovating a house.

It is one of the most important things you should consider if you are intending to purchase an effective fixer upper. A 203(k) mortgage discusses the cost of your house and you can any solutions the latest domestic might need. An advance payment out-of step three.5% of home’s estimated well worth post-home improvements is required. The product quality mortgage is actually for house which need structural solutions and you will the latest improve is actually for property that need repairs that will be non-structural.

Believe 8: Glance at their support system. Renovating a home can be very tiring if you’re carrying it out once the a family, and more and if you’re carrying it out solo. You really need speedycashloan.net student loans for mba to has actually relatives otherwise family relations as possible rely on should your project gets exhausting.

Consideration eight: Think applying for a good FHA 203(k) loan

Attention 9: When it comes to the result, make sure to has actually sensible expectations. A lot of people view family renovation fact suggests towards HGTV and you will assume the sense is a comparable. It is not realistic and will simply set you up to own inability.

Thought ten: Keeps several house inspectors assess the domestic. Domestic inspectors features years of experience at the looking at a variety of family within the numerous standards, so their assistance will come in convenient before you sign one thing. Getting two to three inspectors so you’re able to check the home will ensure you to definitely zero biggest flaws are overlooked.

Happy to buy? If you think today might be the big date, name certainly NLC Loans‘ Personal Financial Advisers within 877-480-8050 to have a no cost, no-chain connected home loan appointment to help you talk about your house financing choice.